tax break refund calculator

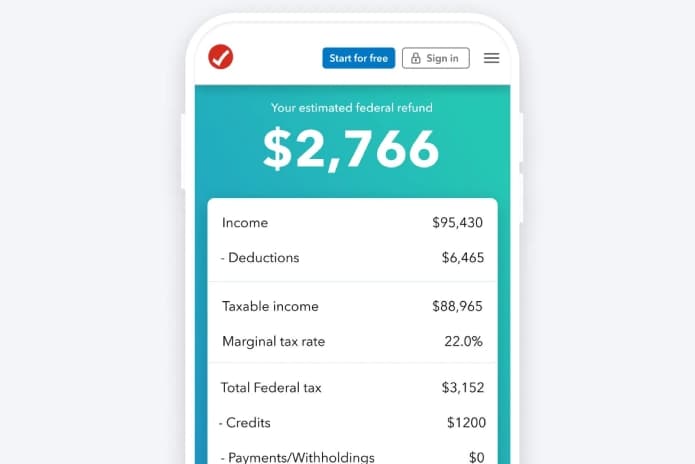

Again whipping out the calculator gives us. Up to 10 cash back Just answer a few simple questions about your life income and expenses and our free tax calculator will give you an idea if you should expect a refund and.

Calculating Your Tax Refund Canada 2022 Turbotax Canada Tips

Most homeowners can deduct all of their mortgage interest.

. This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

It is mainly intended for residents of the US. This means they fall in the 12 tax bracket. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

This calculator is for 2022 Tax Returns due in 2023. Remember this is for federal level only. And is based on the tax brackets of 2021.

The Baker administration has set up a website wwwmassgov62frefunds where you can get a preliminary estimate of your refund. 10200 x 012 1224. More specific information about the timing for refunds will be shared closer to that time.

Distribution of refunds is expected to begin in November 2022. Once you have a good idea of your taxes or if you just want to get your taxes done with start with a free Taxpert account and file federal and. A call center is also now available at 877-677.

You can also create your new 2022 W-4 at the end of the tool on the tax. Youll fill out basic personal and family information to determine your filing status and claim any dependents. No action is needed to receive your refund.

The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their. Up to 10 cash back Our tax refund calculator will do the work for you. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. If you are eligible you will automatically receive a payment. Start the TAXstimator Then select your IRS Tax Return Filing Status.

To be eligible you must have paid personal income taxes in Massachusetts in the 2021 tax year and filed a 2021 state tax return on or before October 17 2022. You can use the estimator below to estimate your refund based on your Tax Year 2021 income tax liability. The Middle Class Tax Refund MCTR is a one-time payment to provide relief to Californians.

What You Need To Know About Gi Bill Benefits And Tax Deductions

2021 Estate Income Tax Calculator Rates

Annual Returns For Payroll Tax Business Queensland

How Do I Calculate My Income Tax In India When I M New To Salary Components

2022 Tax Return How To Factor In Your Child Tax Credit And Covid Costs Npr

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Australian Tax Calculator Excel Spreadsheet 2022 Atotaxrates Info

Top 5 Tax Refund Calculators To Ease Tax Refund Estimate Process

See Your Refund Before Filing With A Tax Refund Estimator

Tax Refund Calculator Free Refund Estimator Estimate Your Taxes

Tax Refund Calculator 2020 2021 Tax Return Estimator Industry Super

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Tax Calculator 2022 Estimate Your Taxes And Refund Now Efile

Tax Refund Calculator Estimate Refund For Free Taxslayer

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Czech Tax Return Tax Deductions And Discounts You Should Know About

Us Child Tax Credit Calculator Expat Tax Online

China Annual Individual Income Tax Reconciliation Tax Refund Faqs

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download